Budgeting for Car Ownership: Saving for a Vehicle Purchase

Introduction

Purchasing a car is a significant financial milestone for many individuals. Whether you're looking to buy your first car or upgrade to a newer model, budgeting and saving play a crucial role in the process. We understand the importance of meticulous planning and financial discipline when it comes to making such a substantial investment. In this guide, we'll walk you through step-by-step on how to save effectively and strategically for your vehicle purchase.

|

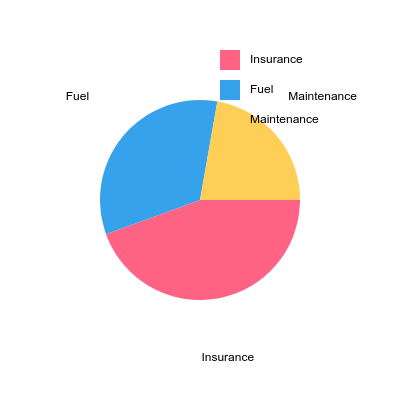

| A pie chart that shows the breakdown of different car expenses like insurance, fuel, and maintenance |

Setting Your Car Budget

1. Assess Your Current Financial Situation

Before diving into the process of saving for a car, it's essential to assess your current financial situation. Take a close look at your income, monthly expenses, and existing debts. Understanding your financial standing will give you a clear idea of how much you can comfortably allocate towards car ownership. Be honest with yourself about what you can afford to avoid getting into financial strain later on.

2. Determine the Total Cost of Ownership

While the initial purchase price is a significant factor, owning a car goes beyond that. It's crucial to consider other costs associated with car ownership. These costs include insurance, registration fees, taxes, maintenance, and fuel expenses. By calculating the total cost of ownership, you get a comprehensive understanding of the financial commitment required for owning a car.

3. Decide on the Type of Car

With a realistic budget in mind, it's time to narrow down your options and decide on the type of car you want to purchase. Different cars come with varying price tags and ongoing costs. Consider your needs, lifestyle, and preferences to find the most suitable vehicle that aligns with your budget. Are you looking for a fuel-efficient compact car for daily commuting or a spacious SUV for family trips? Understanding your requirements will help you make a well-informed decision.

Articles you may also like-

- The Ultimate Guide to Saving Money on Travel

- How to Choose the Best Debt Repayment Method

- Value vs. Growth Investing: Which Investment Style Is Right for You?

Creating a Car Savings Plan

1. Set a Realistic Savings Goal

Now that you have a clear understanding of the total cost of ownership and the type of car you want, it's time to set a realistic savings goal. Break down the total amount into manageable monthly or weekly targets, depending on your preferred timeframe for purchasing the car. Setting achievable goals will keep you motivated throughout the saving process.

2. Open a Dedicated Savings Account

To stay organized and disciplined, it's advisable to open a dedicated savings account specifically for your car fund. This separate account will help you track your progress and avoid the temptation to dip into the savings for other expenses. Opt for a high-yield savings account that offers competitive interest rates to maximize your savings.

3. Automate Your Savings

Consistency is key when it comes to saving for a car. Automate your savings by setting up regular transfers from your main account to the car savings account. By doing this, you ensure consistent contributions without the temptation to skip or delay deposits. Treat your car savings as a non-negotiable expense.

Smart Saving Strategies

1. Cut Unnecessary Expenses

Review your monthly expenses and identify areas where you can cut back. Trim unnecessary expenses and redirect the savings towards your car fund. This could mean reducing dining out, entertainment, or other discretionary spending. Small changes in your daily habits can add up over time, significantly boosting your car savings.

2. Use Windfalls Wisely

Windfalls, such as bonuses, tax refunds, or monetary gifts, provide an excellent opportunity to accelerate your car savings. While it's tempting to splurge on indulgences, using these unexpected funds responsibly will expedite your goal of car ownership. Consider allocating a portion of windfalls directly to your car fund.

3. Consider a Side Hustle

If your current income doesn't allow for aggressive savings, consider taking up a side hustle or part-time job. The additional income can be directly channeled into your car savings, accelerating your progress. Look for opportunities that align with your skills and interests, allowing you to earn extra income without compromising on your primary job.

Comparison Shopping

1. Research Thoroughly

Before making a final decision on the car model, conduct extensive research. Explore various car brands and models that match your preferences and budget. Look into expert and user reviews to gain insights into the reliability and performance of different vehicles. Understanding the market thoroughly will help you make an informed choice.

2. Negotiate and Look for Discounts

Don't hesitate to negotiate the price with the seller or dealer. Dealerships often have some flexibility in pricing, and a well-informed negotiation can lead to cost savings. Additionally, inquire about any available discounts, promotions, or special financing offers that could make your car purchase more affordable.

Considering Financing Options

1. Save for a Down Payment

If you plan to finance your car purchase, aim to save for a substantial down payment. A larger down payment can lower your monthly loan payments and potentially reduce the overall interest you'll pay. By saving diligently, you'll also demonstrate financial responsibility to lenders, which may improve your loan terms.

2. Explore Financing Terms

Before committing to a car loan, thoroughly understand the financing terms and conditions. Compare interest rates from different lenders and opt for the most favorable terms that suit your financial capacity. Be cautious about taking on a loan with burdensome interest rates or hidden fees.

Final Thoughts

Owning a car can bring convenience and freedom to your life, but it's essential to approach the process with careful planning and budgeting. By setting a realistic savings goal, adopting smart saving strategies, and conducting thorough research, you'll be well on your way to purchasing your dream vehicle without compromising your financial stability.

Remember, every dollar saved counts, and with dedication and discipline, you can achieve your car ownership goals sooner than you think.